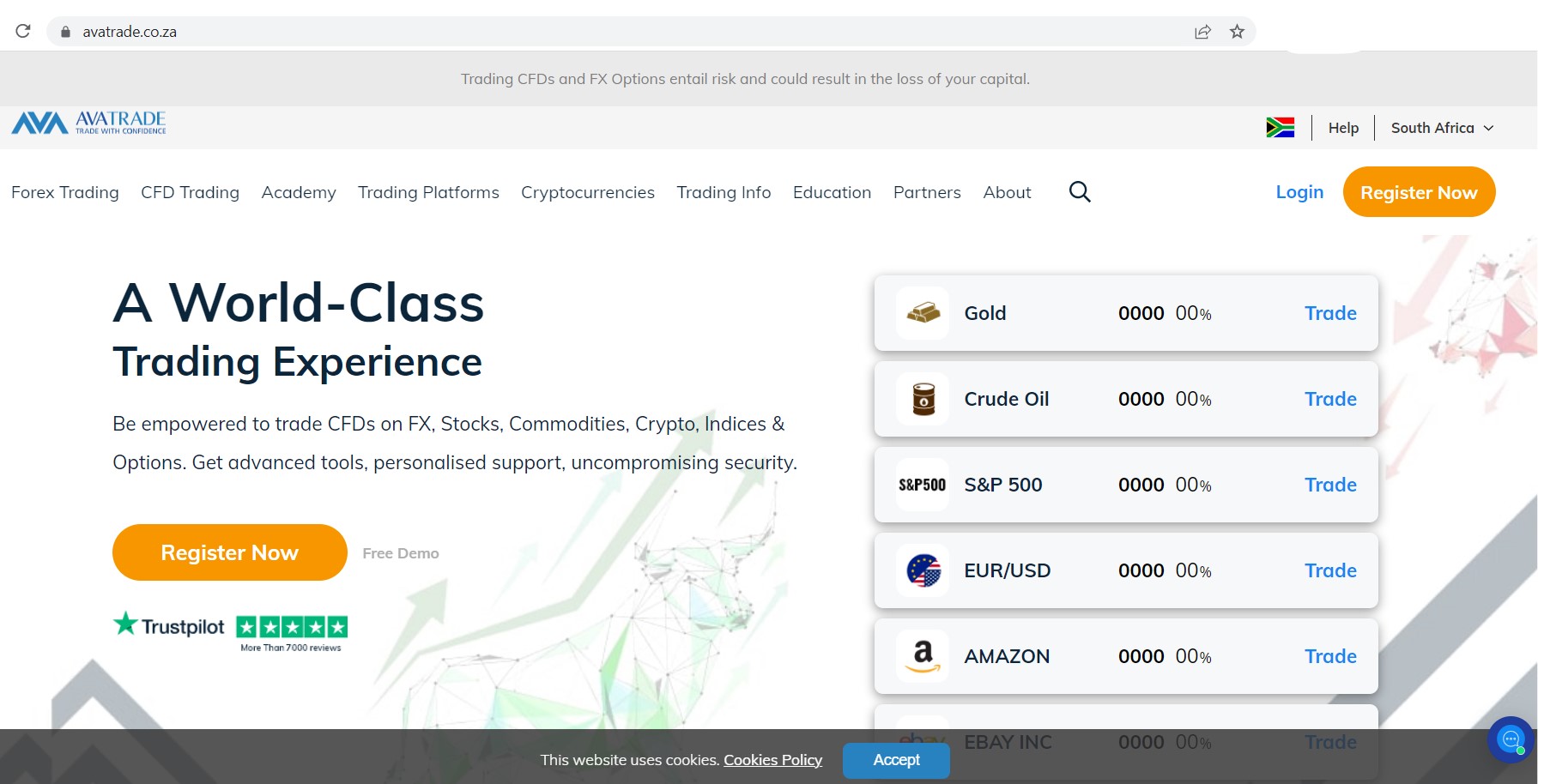

In this review, we will explore the features and benefits of AvaTrade South Africa, including the trading instruments available, account types, trading platforms, customer support, and more.

Leading FX Brokers in South Africa

R100 Deposit

100% Bonus

Regulation and Safety

AvaTrade South Africa is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is responsible for regulating financial institutions in the country. This regulation ensures that the platform adheres to strict guidelines and standards, ensuring that traders’ funds are secure and protected.

In addition to FSCA regulation, AvaTrade is also regulated by other top-tier regulatory bodies such as the Central Bank of Ireland, ASIC, and the Financial Services Commission of the British Virgin Islands, providing an extra layer of security for traders.

Account Types

AvaTrade South Africa offers a range of account types to suit different trading styles and experience levels. These account types include:

- Demo Account: A free demo account is available for traders who want to practice their trading skills and test out the platform’s features and tools before investing real money.

- Retail Account: The retail account is designed for beginner and intermediate traders and requires a minimum deposit of $100.

- Professional Account: The professional account is designed for experienced traders who require more advanced trading tools and features. To qualify for a professional account, traders must meet certain criteria, such as having a minimum of two years of trading experience and meeting certain financial criteria.

Trading Instruments

AvaTrade South Africa offers a wide range of trading instruments across multiple asset classes, including:

- Forex: AvaTrade offers over 55 currency pairs, including major, minor, and exotic pairs.

- Stocks: Traders can trade over 700 stocks from some of the world’s largest companies, including Apple, Amazon, and Facebook.

- Cryptocurrencies: AvaTrade offers trading on popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin.

- Commodities: Traders can trade on a range of commodities, including gold, silver, and crude oil.

Trading Platforms

AvaTrade offers a range of trading platforms to suit different trading styles and preferences, including:

- MetaTrader 4: The industry-standard trading platform that offers advanced charting tools, trading indicators, and order management tools.

- AvaTradeGO: A mobile trading app that offers easy access to trading tools and resources, as well as real-time market updates.

- WebTrader: A web-based trading platform that allows traders to access their accounts and trade from any web browser.

- AvaOptions: A platform that allows traders to trade forex options, providing access to advanced risk management tools and strategies.

Trading Tools and Resources

AvaTrade offers a range of trading tools and resources to help traders make informed trading decisions, including:

- Economic Calendar: A calendar that provides real-time updates on upcoming economic events and their impact on the markets.

- Trading Central: A tool that provides technical analysis and trading signals to help traders make informed trading decisions.

- AvaProtect: A risk management tool that allows traders to protect their trades from market volatility by paying a small premium.

- AutoChartist: A tool that provides real-time market analysis and trading signals based on technical analysis.

Customer Support

AvaTrade South Africa offers 24/5 customer support in multiple languages, including English, Spanish, French, and Italian. Traders can contact the support team via live chat, email, or phone, and the platform also offers an extensive FAQ section and educational resources to help traders get started and improve their trading skills.

Deposit and Withdrawal Options

AvaTrade South Africa offers a range of deposit and withdrawal options to make it easy for traders to fund their accounts and withdraw their profits. These options include:

- Credit and Debit Cards: Traders can use their Visa or Mastercard to make deposits and withdrawals.

- Bank Transfer: Traders can transfer funds directly from their bank accounts to their AvaTrade accounts.

- Electronic Payment Systems: Traders can use e-wallets such as Skrill, Neteller, and WebMoney to make deposits and withdrawals.

- Cryptocurrency: AvaTrade South Africa allows traders to deposit and withdraw funds using Bitcoin.

Avatrade Minimum Deposit and Withdrawal

The minimum deposit for AvaTrade South Africa is $100, making it accessible to traders of all levels. The minimum withdrawal amount is $50, and withdrawals are processed within 1-2 business days, depending on the payment method used.

Education and Research

AvaTrade South Africa offers a range of educational resources and research tools to help traders improve their trading skills and stay up-to-date with market trends. These resources include:

- Video Tutorials: A series of video tutorials that cover a range of topics, from basic trading concepts to advanced strategies.

- Webinars: Live webinars hosted by trading experts that provide insights into market trends and trading strategies.

- Trading eBooks: A range of eBooks that cover different trading topics, including forex, stocks, and cryptocurrencies.

- Trading Tools: AvaTrade offers a range of trading tools, including a calculator that helps traders calculate their potential profits and losses, as well as a margin calculator that helps traders manage their leverage.

Conclusion

AvaTrade South Africa is a well-regulated and reliable trading platform that offers a wide range of trading instruments, account types, and trading platforms to suit different trading styles and preferences. The platform also provides excellent customer support, educational resources, and research tools to help traders improve their trading skills and make informed trading decisions. With a minimum deposit of $100 and a range of deposit and withdrawal options, AvaTrade South Africa is an accessible and convenient trading platform for traders of all levels.

Avatrade South Africa FAQs

How do I contact AvaTrade?

Here are the avatrade South Africa contact details: +(27)319800174

Is AvaTrade available in South Africa?

Yes, Avatrader products including AvaTradeGO app are available for traders in South Africa.

Does AvaTrade have ZAR account?

Unfortunately, AvaTrade does not provide South African clients with the option to have ZAR as their account currency. The platform only supports USD, EUR, and GBP as base currency options. However, clients can make bank wire deposits in ZAR to AvaTrade’s account, and the amount will be converted to USD or the client’s selected account currency on the platform.

Can I trust AvaTrade?

Yes, AvaTrade South Africa is a highly trustworthy platform, with an impressive Trust Score of 4.5 out of 5.

No reviews yet