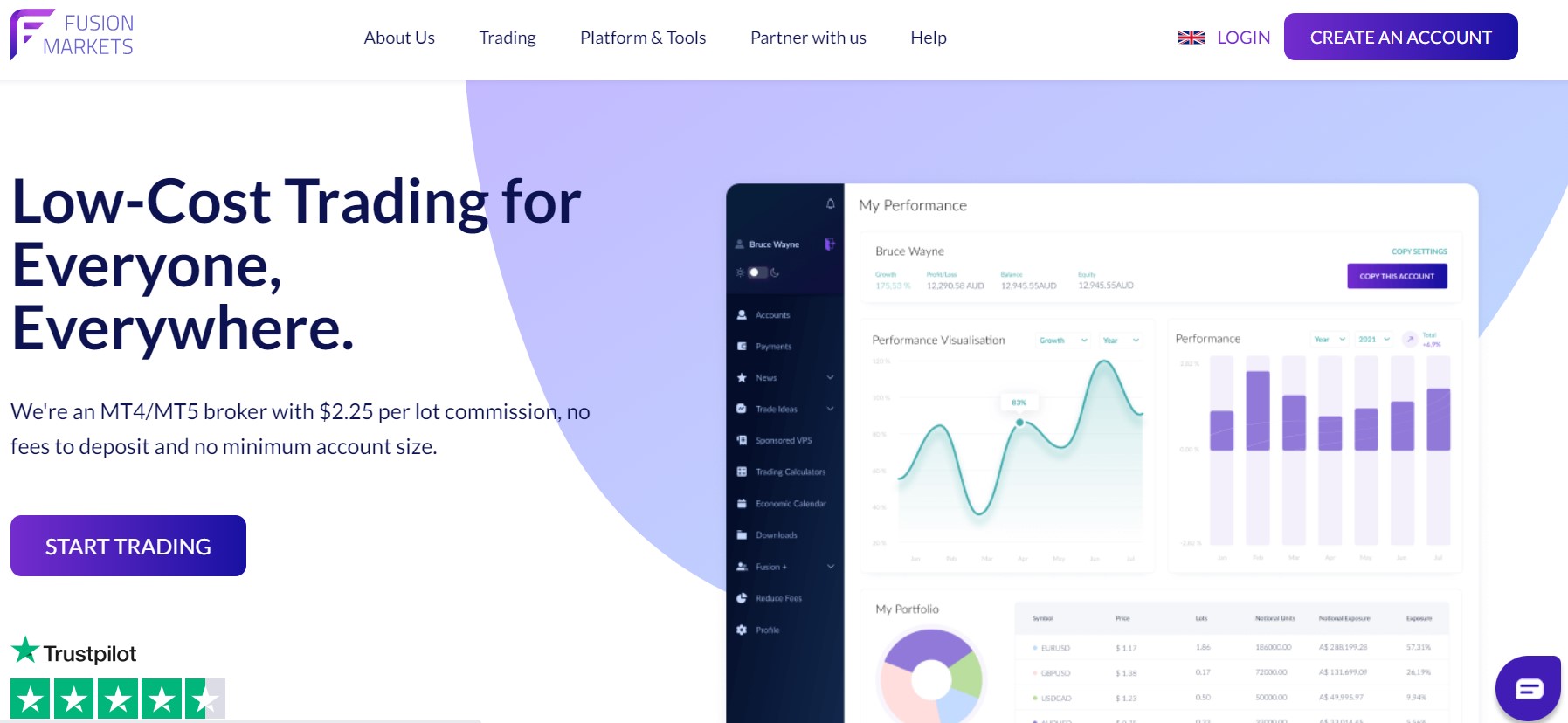

Fusion Markets is now expanding its services to South Africa, providing local traders with a reliable, secure, and user-friendly platform to trade forex, CFDs, and other financial instruments. In this review, we will explore the features, advantages, and drawbacks of Fusion Markets South Africa.

The Best Forex Brokers South Africa

R100 Deposit

100% Bonus

Regulation and Security

Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), one of the most respected regulatory bodies in the financial industry. The broker follows strict rules and guidelines to ensure the safety of client funds, including segregation of funds, negative balance protection, and insurance coverage. Moreover, Fusion Markets uses the latest encryption technology to secure all communication and transactions on its platform, providing a safe and transparent trading environment for South African traders.

Account Types

Fusion Markets offers two types of accounts for South African traders: the Classic Account and the Zero Account. The Classic Account has no commissions and offers competitive spreads, starting from 0.8 pips for major forex pairs. The Zero Account, on the other hand, has a commission of $4.50 per lot, but offers raw spreads starting from 0.0 pips for major forex pairs, with no markups or hidden fees. Both account types have a minimum deposit requirement of $100 and offer leverage up to 500:1.

Trading Platform

Fusion Markets South Africa provides its clients with the popular MetaTrader 4 (MT4) trading platform, which is known for its advanced charting tools, customizable interface, and expert advisor (EA) functionality. The platform is available for desktop, web, and mobile devices, allowing traders to access their accounts and trade from anywhere, at any time. Fusion Markets also offers a range of educational resources, including trading tutorials, market analysis, and economic news, to help traders make informed decisions.

Trading Instruments

Fusion Markets South Africa offers a wide range of trading instruments, including forex, indices, commodities, cryptocurrencies, and more. With over 90 forex pairs and 30 indices to choose from, South African traders can diversify their portfolio and take advantage of market volatility. The broker also offers trading in popular cryptocurrencies, such as Bitcoin, Ethereum, and Litecoin, allowing traders to benefit from the fast-growing crypto market.

Customer Support

Fusion Markets South Africa provides excellent customer support, with a dedicated team available 24/5 to answer any questions or concerns. Traders can contact the support team via email, phone, or live chat, and expect a prompt and professional response. The broker also has a comprehensive FAQ section on its website, covering a wide range of topics, from account opening to trading strategies.

Advantages

- Regulated by ASIC, ensuring a high level of security and transparency.

- Low spreads and fast trade execution, with no requotes or slippage.

- Competitive commissions on the Zero Account, with raw spreads starting from 0.0 pips.

- Wide range of trading instruments, including forex, indices, commodities, and cryptocurrencies.

- Excellent customer support, available 24/5 via email, phone, or live chat.

- Educational resources, including trading tutorials, market analysis, and economic news.

Drawbacks

- Limited account types, with no option for Islamic accounts.

- No social trading or copy trading functionality.

- Limited research tools, with no proprietary research or analysis.

Conclusion

Thank you for reading this Fusion Markets South Africa review. In conclusion, Fusion Markets is a trustworthy and reliable broker that provides traders with a comprehensive range of trading instruments, including forex, CFDs, and cryptocurrencies. The broker offers competitive trading conditions, including tight spreads, low commissions, and fast execution speeds.

Fusion Markets South Africa is an excellent choice for South African traders looking for a regulated and safe broker. The company is licensed by the FSCA, ensuring that client funds are segregated and protected. Moreover, the broker provides traders with a range of trading tools, educational materials, and a user-friendly trading platform.

No reviews yet